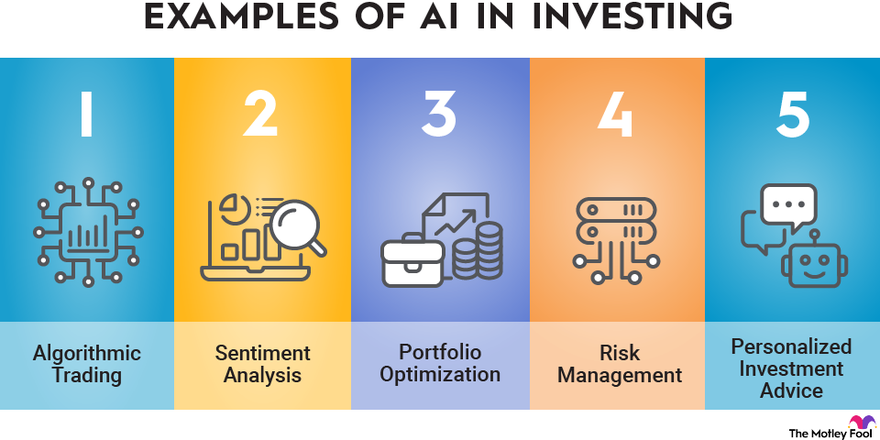

Artificial Intelligence is transforming the world of finance. From analyzing massive datasets to predicting market trends and automating trades, learning how to use AI for investing can give you a powerful edge in today’s fast-moving markets.

Whether you’re a beginner investor or managing a portfolio, AI can help you:

- Spot investment opportunities faster

- Reduce emotional decision-making

- Track real-time market data

- Automate trades based on logic

- Improve risk management

1. Use AI for Market Analysis & Trend Prediction

What it does:

AI models process vast amounts of historical and real-time data—including news, earnings reports, economic indicators, and social sentiment—to identify patterns and forecast price movements.

How to use it:

- Try platforms like:

- Tickeron – AI scans thousands of stocks for trend-based signals

- Kavout – Uses machine learning to rank stocks by performance potential

- Sentieo – Search engine for financial research powered by NLP

📌 Best for: Day traders, swing traders, and long-term investors looking for data-backed insights.

2. Automate Trades with AI-Powered Bots

What it does:

AI trading bots execute buy/sell orders automatically based on pre-set rules and conditions.

How to use it:

- Choose a platform like:

- Alpaca – API-based trading with AI integration

- MetaTrader 5 (MT5) – Supports AI/EA (Expert Advisors) trading bots

- 3Commas , Cryptohopper – For crypto + stock algo trading

- Set up strategies (e.g., moving average crossovers, RSI thresholds)

- Let the bot trade while you sleep!

💡 Tip: Always backtest your strategy before going live.

3. Track Sentiment with AI News & Social Media Analysis

What it does:

AI scans news articles, Twitter/X posts, Reddit threads, and forums to gauge public sentiment about stocks or companies.

How to use it:

- Try tools like:

- StockSniper – Analyzes Reddit, Twitter, and news for hype around stocks

- Bloomberg Terminal (AI-enhanced) – Advanced sentiment tracking for professionals

- ChatGPT / Gemini – Paste news articles and ask AI to summarize the sentiment

📌 Best for: Tracking short-term volatility around trending assets or IPOs.

4. Improve Portfolio Management with AI Insights

What it does:

AI helps assess portfolio risk by simulating different market scenarios and suggesting optimal asset allocations.

How to use it:

- Use platforms like:

- Betterment , Wealthfront – Robo-advisors powered by AI

- Portfolio Visualizer – Backtesting with AI modeling

- Input your goals and let AI recommend adjustments to reduce volatility or maximize returns.

📝 Tip: Combine AI with your own risk tolerance and investment goals.

5. Get Smart Investment Advice from AI Advisors

What it does:

Robo-advisors use AI to provide personalized investment advice based on your financial goals, risk profile, and time horizon.

How to use it:

- Use services like:

- Betterment – Offers smart investing plans with no minimums

- Wealthsimple – AI-driven investing with human support options

- Ellevest – Tailored investing for women

- Answer a few questions and let AI build and manage your portfolio.

💡 Bonus: These platforms often rebalance your investments automatically.

6. Analyze Company Reports & Earnings with AI

What it does:

AI reads through quarterly reports, SEC filings, and earnings calls to extract key insights and flag red flags.

How to use it:

- Use tools like:

- Narrativa – Turns financial data into plain-language summaries

- ScribeSense – Analyzes earnings call transcripts for sentiment and risk

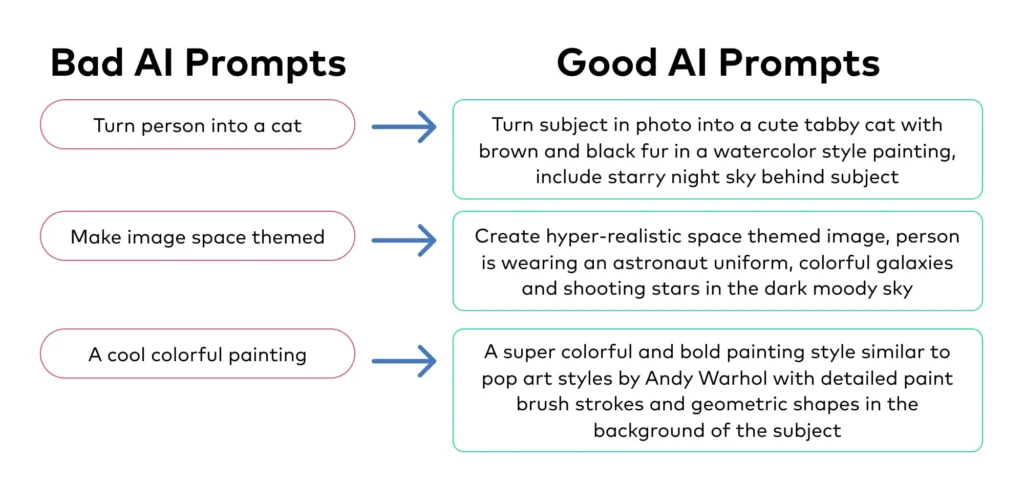

- ChatGPT / Gemini – Ask:”Summarize Apple’s latest earnings report in 10 bullet points.”

“Highlight any risks mentioned in this 10-K filing.”

📊 Final Tips for Using AI in Investing

- Start small—use AI for one task at a time (e.g., sentiment tracking or portfolio balancing).

- Always verify AI insights with trusted sources and your own knowledge.

- Avoid over-reliance on AI—investing still requires judgment and risk awareness.

- Stay updated—new AI finance tools are released every week.

- Be cautious of “guaranteed win” AI promises—always test results before investing real money.

🔧 Popular AI Tools for Investors

| Tool | What It Does |

|---|---|

| Tickeron | AI-generated trading signals and pattern recognition |

| Wealthfront | Robo-advisor with AI portfolio optimization |

| ChatGPT / Gemini | Summarizes reports, analyzes sentiment, explains financial terms |

| Sentieo | Financial search engine with AI-powered research |

| 3Commas | Crypto and stock trading bots with smart strategies |

| Portfolio Visualizer | Backtests investment strategies using AI modeling |

📌 Tip: Many offer free trials—test before committing.

❓ Frequently Asked Questions (FAQs)

Q1: Can AI accurately predict stock prices?

A: AI can identify patterns and probabilities, but it cannot guarantee 100% accuracy due to the unpredictable nature of markets. It works best as a support tool rather than a crystal ball.

Q2: Is AI investing legal and safe?

A: Yes, AI investing is legal and widely used by hedge funds and individual traders. However, always ensure compliance with your broker’s terms and local regulations.

Q3: Do I need coding skills to use AI for investing?

A: Not necessarily! Many platforms offer no-code or low-code AI tools for trading and portfolio management. However, knowing some programming gives you more flexibility and control.

Would you like this formatted as a Gutenberg-ready HTML block , or exported as a PDF or Word (.docx) file for easy upload to your WordPress site? Let me know and I’ll prepare it for you!

0 Comments