Artificial Intelligence is transforming the world of finance — and accounting is no exception . From automated data entry to real-time financial reporting , AI-powered tools are helping businesses reduce errors, save time, and make better financial decisions.

Modern accounting platforms now come with built-in AI features that help automate repetitive tasks and provide intelligent insights. These tools can:

- Categorize transactions automatically

- Extract data from invoices and receipts

- Detect anomalies or potential fraud

- Generate reports and forecasts

- Provide real-time tax compliance suggestions

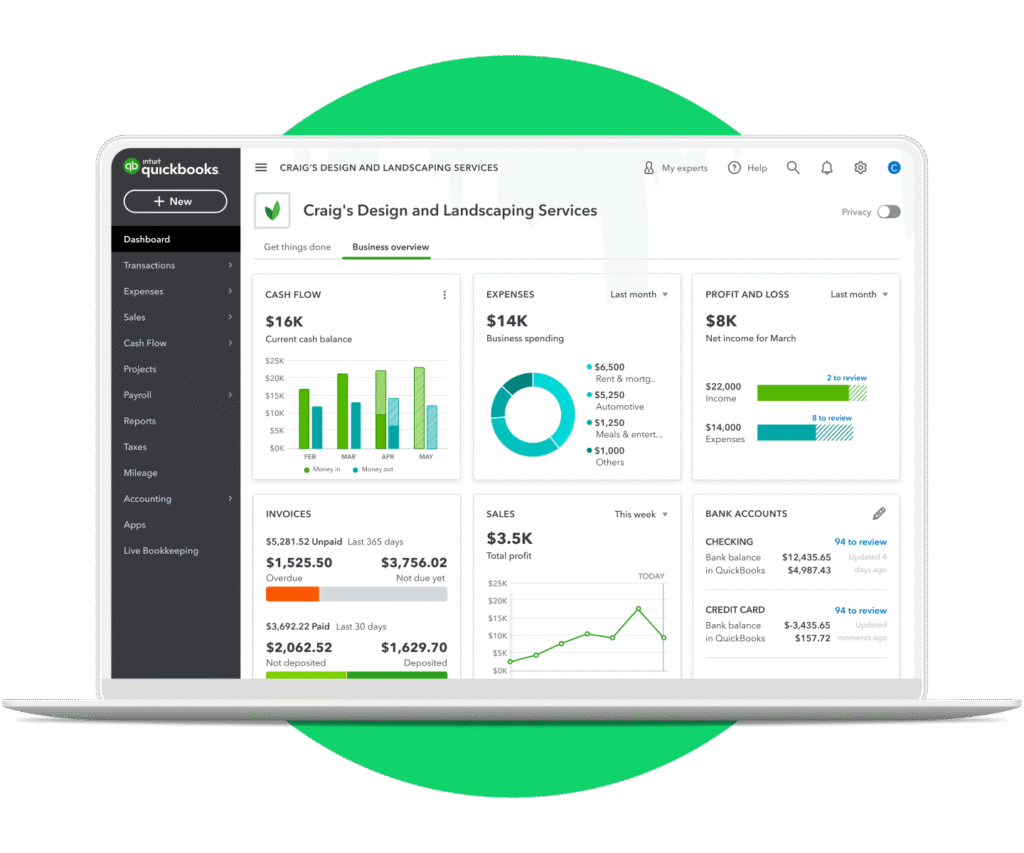

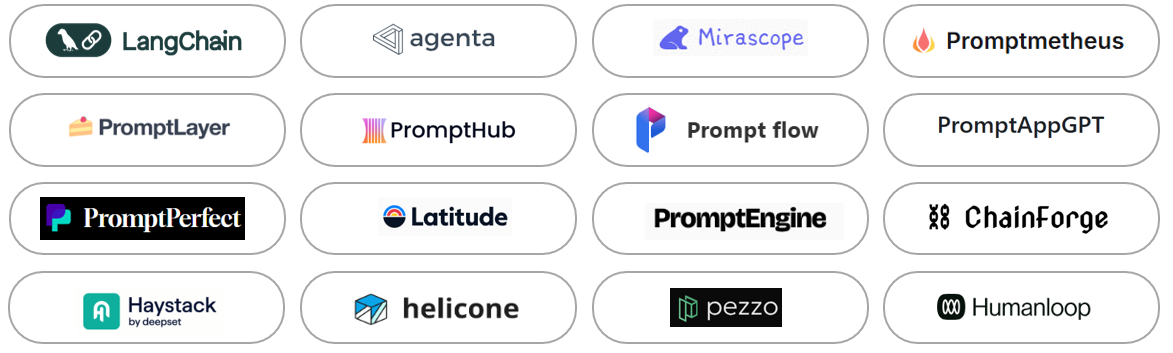

Some popular AI-integrated accounting platforms include:

- QuickBooks Online

- Xero with AI add-ons

- FreshBooks

- Sage Intacct

- Zoho Books

These platforms use machine learning algorithms to learn from your data and continuously improve their performance.

Here are some of the most powerful ways to use AI in accounting :

1. Automate Data Entry and Invoice Processing

One of the biggest time-savers in AI accounting is automated data extraction from documents like invoices, receipts, and bank statements.

To use this feature:

- Upload a scanned invoice or receipt

- The AI will extract key details like:

- Vendor name

- Amount due

- Date

- Tax information

- It then auto-maps the data to the correct fields in your system

This eliminates manual entry and reduces human error — especially useful for high-volume transactions.

🧠 Pro Tip: Use AI-powered OCR (Optical Character Recognition) tools like Docyt , KashFlow , or Botkeeper for even faster document processing.

2. Smart Expense Tracking and Categorization

AI helps simplify expense management by learning from past entries and applying those patterns to new transactions.

How it works:

- When you connect your bank accounts, AI identifies recurring vendors and categories

- Over time, it begins suggesting or auto-filling categories based on previous behavior

- You can review and approve suggestions with just one click

This makes month-end closing much faster and more accurate.

3. Real-Time Financial Reporting and Forecasting

AI doesn’t just record transactions — it helps you understand what they mean .

With AI-driven analytics:

- Get instant insights into cash flow trends

- Predict future revenue and expenses

- Spot unusual spending patterns

- Receive alerts when budgets are at risk of being exceeded

Tools like Power BI with AI integrations , QuickBooks Advanced , and Fathom offer dashboards that update in real time — giving you a clear picture of your financial health at any moment.

4. Detect Fraud and Anomalies Automatically

Fraud detection is another powerful application of AI in accounting. These systems analyze transactional patterns and flag anything out of the ordinary, such as:

- Duplicate payments

- Unusual vendor activity

- Out-of-pattern purchases

- Suspicious invoice amounts

By catching red flags early, AI helps prevent financial losses before they become serious issues.

5. Streamline Tax Compliance and Planning

AI tools can help ensure your business stays compliant by:

- Identifying tax-deductible expenses

- Calculating sales tax automatically

- Flagging missing documentation

- Offering tax-saving recommendations based on your financial behavior

Platforms like H&R Block’s Axonify and Intuit’s TurboTax with AI support guide users.

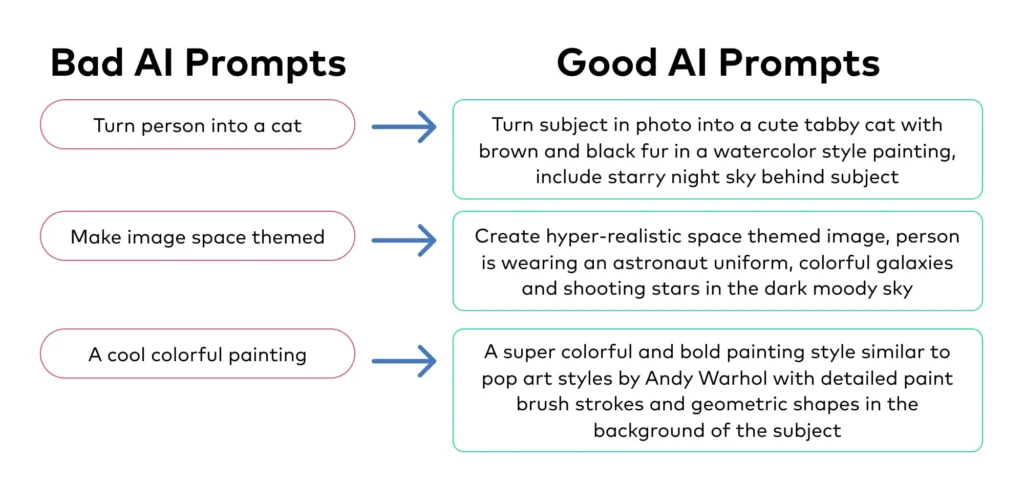

6. Chat with Your Financial Data

Some AI accounting tools now allow you to ask natural language questions about your finances — just like talking to a real-time assistant.

Try prompts like:

- “What was our total revenue last quarter?”

- “Show me all unpaid invoices over $1,000”

- “Compare this month’s expenses to last month”

AI-powered assistants like QuickBooks Assistant , Xero AI , or ChatGPT plugins for accounting respond instantly — turning raw numbers into meaningful answers.

7. Improve Client Communication with AI-Powered Insights

For accounting professionals, AI can also enhance client service by:

- Generating easy-to-understand financial summaries

- Sending automated updates and reminders

- Creating visual dashboards tailored to each client

- Suggesting next steps like budget adjustments or investment opportunities

This not only improves transparency but also adds value to every client interaction.

Final Thoughts

Using AI in accounting isn’t about replacing human expertise — it’s about enhancing it. Whether you’re running a solo practice or managing a corporate finance team, AI tools can help you work smarter, not harder.

From automating data entry to providing predictive insights and improving client communication, AI is reshaping how we handle money — making accounting faster, cleaner, and more strategic than ever.

Ready to get started? Choose an AI-enhanced accounting platform, test its features, and start saving hours every week.

📷 Want more finance tech tips? Follow us for weekly updates on AI tools, accounting software, and how to run your business smarter with artificial intelligence.

Frequently Asked Questions

Is AI in accounting safe and secure?

Yes, most modern AI accounting tools use encrypted cloud storage, role-based access controls, and comply with financial regulations like GDPR and SOC 2 standards.

Do I need technical skills to use AI in accounting?

No! Most AI features are built directly into accounting platforms and require no coding or setup — just log in and start using them.

Can AI replace accountants?

No, AI handles repetitive tasks and analysis, but strategic decision-making, audits, and advisory services still require human judgment and expertise.

0 Comments