Artificial intelligence has changed the way people trade financial markets. Whether you’re into stocks , crypto , or forex , using an AI bot for trading can help you make faster decisions, spot trends, and even execute trades automatically — all while reducing emotional bias.

If you’re new to algorithmic trading or looking to upgrade your strategy, here’s how to get started using AI bots effectively.

Choosing the Right AI Trading Bot

Not all AI bots are created equal. Some specialize in cryptocurrency, others in stock markets or forex. Here are a few popular options:

- TradingView + Autochartist : For technical analysis and alerts

- Coinrule : Great for automating crypto trades based on custom rules

- Altrady / Cryptohopper : Full-featured crypto trading bots

- MetaTrader 5 with Expert Advisors (EAs) : Popular for forex and CFDs

- TrendSpider : Combines AI with real-time charting and strategy testing

Look for features like backtesting, auto-trading, risk management tools, and integration with your exchange or broker.

Setting Up Your AI Bot

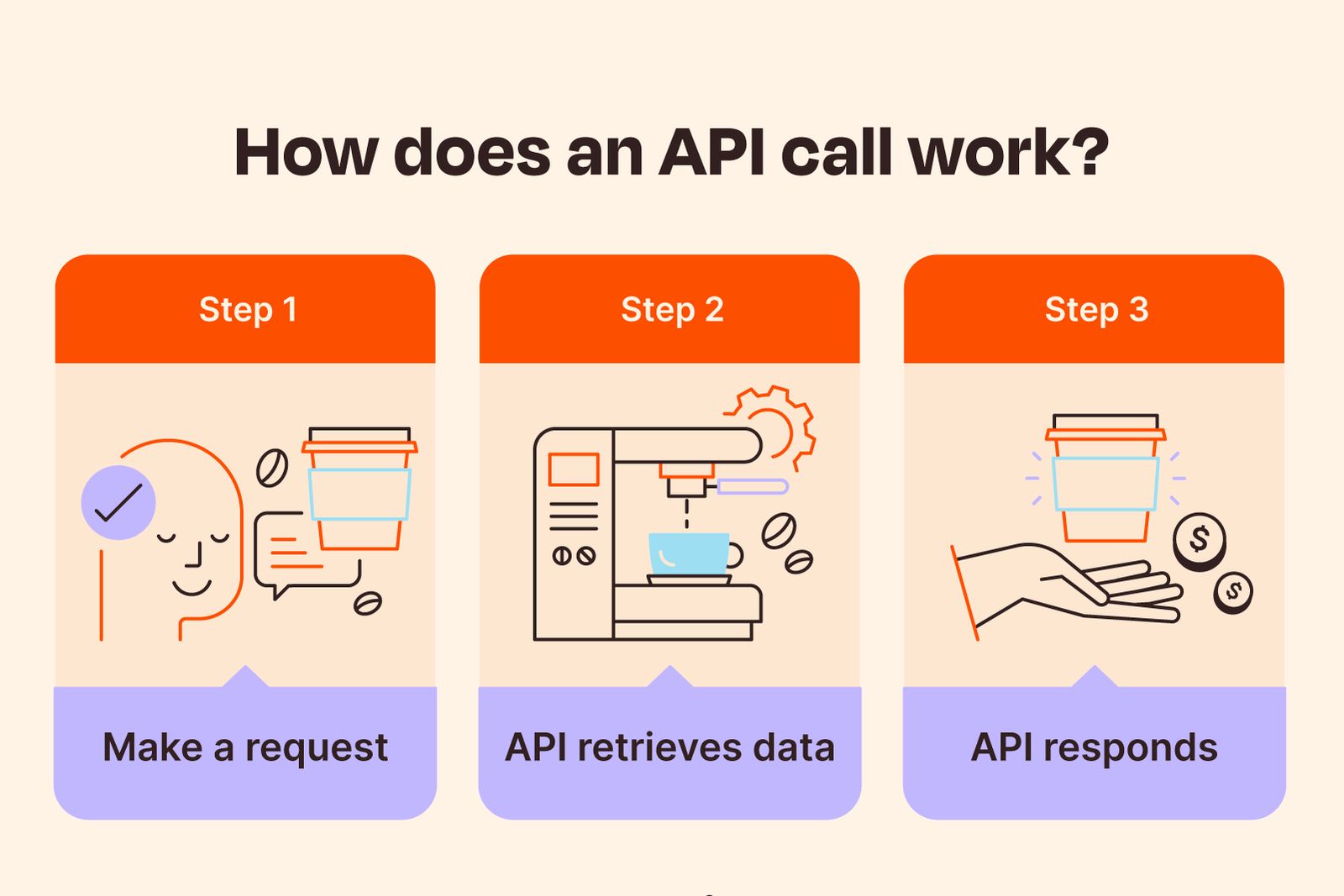

Once you’ve chosen a bot, follow these basic steps to start trading:

- Connect Your Exchange Account – Most bots support API keys for secure access.

- Select Market & Asset – Choose whether you want to trade crypto, stocks, or forex.

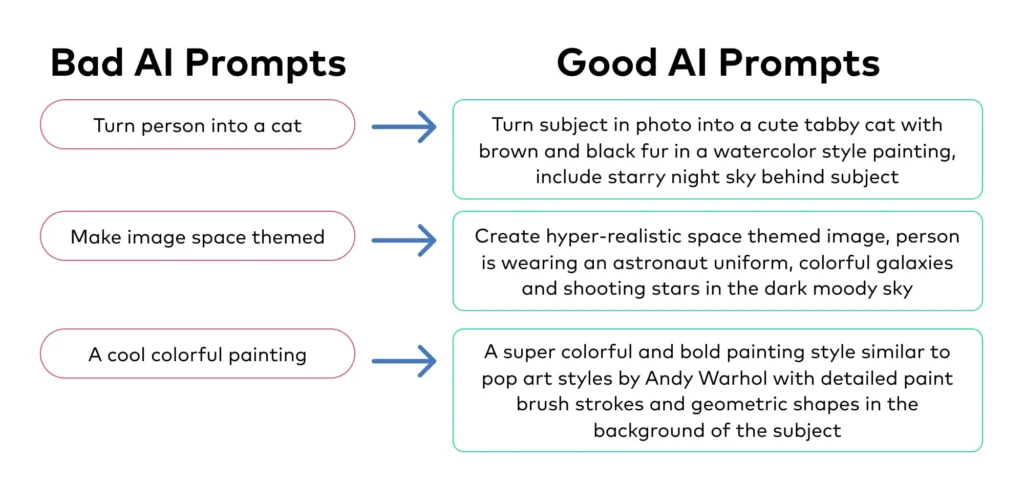

- Set Trading Rules – Define indicators like RSI, MACD, moving averages, or set stop-loss/take-profit levels.

- Test with Paper Trading – Many platforms let you simulate trades before risking real money.

- Go Live or Monitor Manually – Decide if you want full automation or just AI-driven suggestions.

Always start with small investments until you understand how the bot behaves in real conditions.

Types of Strategies You Can Run

AI bots allow you to implement various trading strategies with precision:

- Day Trading – Bots analyze real-time data and execute quick trades.

- Swing Trading – Uses historical patterns and trend detection to catch price swings.

- Arbitrage – Exploits price differences between exchanges (common in crypto).

- Portfolio Rebalancing – Automatically adjusts asset allocation based on goals.

- News-Based Trading – Some advanced bots scan news or sentiment to predict price moves.

The key is to test and refine your strategy using historical data before deploying it live.

Managing Risk with AI

Even though AI can boost performance, it’s crucial to manage risks:

- Set stop-loss and take-profit limits

- Avoid over-leveraging your account

- Regularly review bot performance

- Diversify across assets and strategies

- Keep your API keys secure and never share them

Many AI bots offer built-in risk control tools — use them wisely.

FAQs: Frequently Asked Questions About Using AI Bots for Trading

Q1: Can AI bots guarantee profits in trading?

No. While AI improves accuracy and speed, markets are unpredictable. Always trade responsibly and be prepared for losses.

Q2: Do I need coding skills to use AI trading bots?

Most platforms today are user-friendly and require no coding. However, some advanced customization may involve scripting.

Q3: Are AI trading bots legal?

Yes, as long as they comply with the terms of service of the exchange or brokerage you’re using.

0 Comments